The World Bank predicts a historic oil surplus that will cause prices to fall in 2025.

The World Bank predicts that in 2024-2025 global oil supply will exceed demand by an average of 1.2 million barrels per day. This surplus will likely limit the price effects from an even wider conflict in the Middle East. Such a significant oversupply has only been observed twice before – during the 2020 Covid shutdowns and the 1998 oil price collapse.

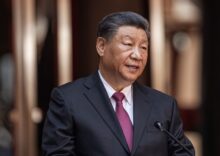

One of the critical drivers of overproduction is the slowdown in industrial production and increased sales of electric cars in China. In addition, an increase in oil production in non-OPEC+ countries is expected. The price of Brent oil will hover around $75 a barrel until the end of 2024 before falling to $73 in 2025 and $72 in 2026.

Meanwhile, despite sanctions, Russian oil exports by sea are growing for the second week in a row. Last week, 32 tankers loaded 24.79 million barrels of oil (23.93 million barrels the previous week).